Office Equipment Industry is being Disrupted

Office as a Subscription era?

I’ve been recently enjoying my morning brew and browsing Linkedin when it suggested me a product exec position at Lendis. You can imagine my curiosity level so I jumped in to understand what these guys are working on:

With our innovative software solution, we simplify the way companies select, procure & manage their work equipment and focus on what matters - the success of the business.

Equipment supplier? Hope there’s more to that :). Let’s see.

Just a few clicks and you're done. We take care of the equipment, delivery, software licences and everything in between.

Ok, what’s Lendis strategy to compete with incumbent suppliers?

As one smart guy said: people think strategy is about profit, but really, it’s about power. Profit is just the prize.

I’ll use Michael Porter’s “Competitive Advantage: Creating and Sustaining Superior Performance” value chain approach to explore how Lendis obtains power and their strategy to win.

A value chain is a concept describing the full chain of a business's activities in the creation of a product or service. From emerging of the customer’s need to its fulfilment and beyond to how this fulfilment has been created.

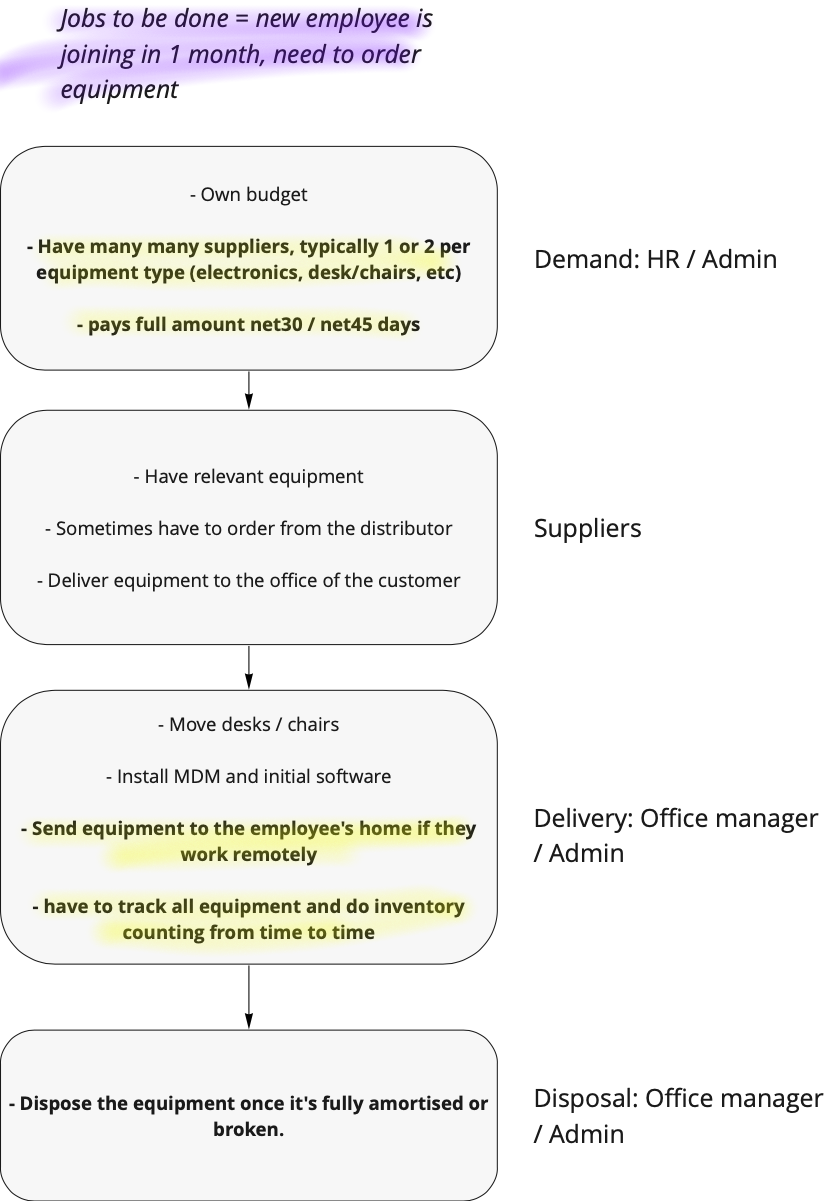

Let’s make a high-level value chain of current equipment procurement process:

The following key value chain elements of the incumbent model are being disrupted:

fragmented supplier state;

payment terms;

equipment disposal / end of life.

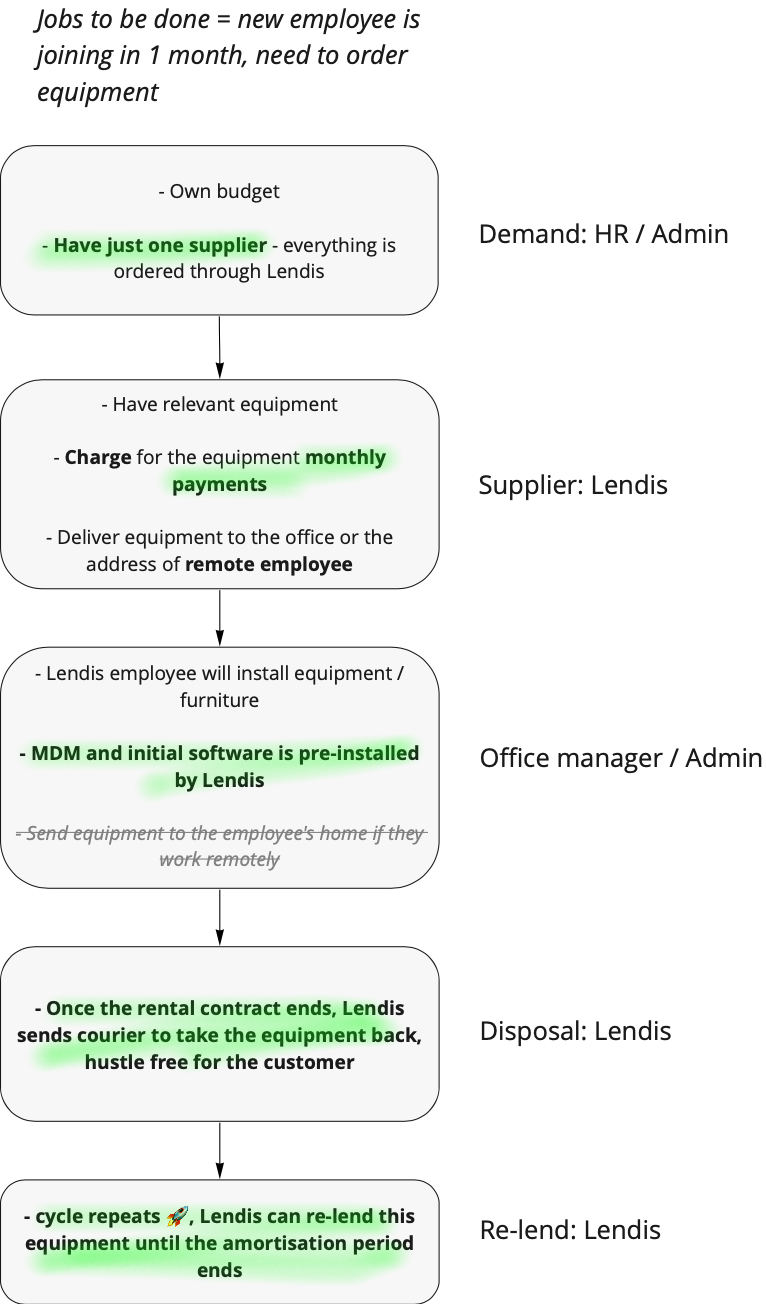

Lendis aggregates fragmented supply side by purchasing common equipment that companies need for an ergonomic workplace and lending it to the companies. This includes height-adjustable desks, laptops and other things.

Let’s look at the value chain to understand whether the new business model is more superior:

So what does Lendies do to win power?

takes all the hustle from the office manager/admin/hr to work with many equipment providers;

[more importantly] provides flexibility of capital allocation for companies by lending equipment;

customer quote: Lendis has saved us a large investment. The new equipment would have cost us $50,000.

[power, coming from the previous point] Lendis can re-lend the equipment and make higher margins on the assets they lend vs they would have sold it to the customer.

The value chain for any given consumer market is divided into three parts: suppliers, distributors, and customers. The best way to make outsize profits in any of these markets is to either gain a horizontal monopoly in one of the three parts or to integrate two of the parts such that you have a competitive advantage in delivering a vertical solution. Lendis does exactly the later.

Moreover the ability to make higher margins on lending equipment vs selling it allows to unlocks Lendis growth levers not available to traditional suppliers:

scale the customer base rapidly because they can spend more $$ on the acquisition;

raise debt to scale the ability to buy equipment and support customer base growth;

Lendis recently raised €80m, through a combination of debt and equity from Circularity Capital and Keen Venture Partners, HV Capital, DN Capital, Picus Capital and Coparion. My assumption is the majority (60-70%) of the round was debt.

The question I am most interested in, though, is a different one: the company operates in Germany, Austria and Switzerland and plans to scale within EU. Aggregating supply would require heavy logistics operations, I wonder whether it would be a hard ceiling to crack?