A Game-Changing Time for Vertical SaaS

Back in 1998, Michael Porter introduced four competitive strategies in his Competitive Advantage book, and it’s been a staple in business schools and practice ever since. The strategies that might seem utterly oversimplified are:

Horizontal + low cost

Horizontal + differentiated

Vertical + low cost

Vertical + differentiated

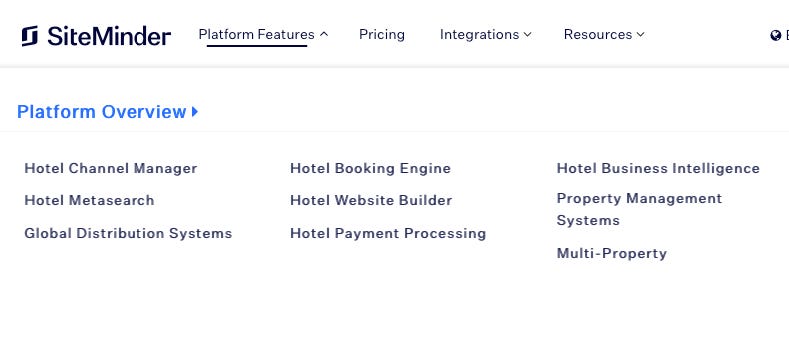

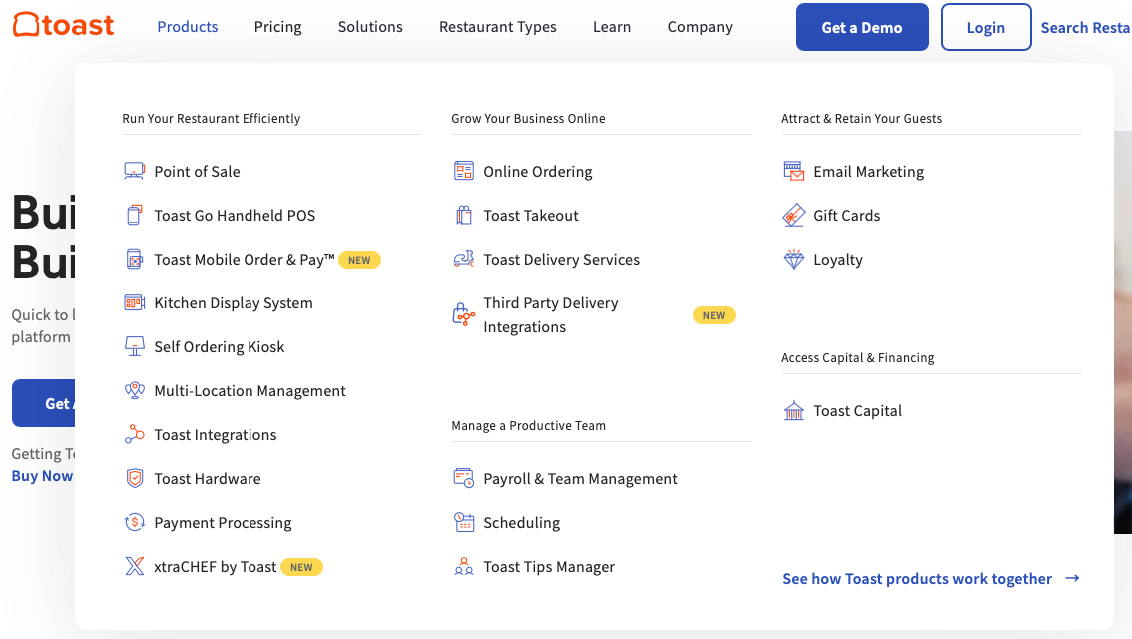

In the recent 10-15 years we’ve seen the myriad of horizontal SaaS businesses that were selling broad: Notion, Airtable, Dropbox, Slack, Asana, Zoom, Canva, etc. There’ve been numerous insanely successful Vertical SaaS Vendors as well like Figma, Toast, SiteMinder, Atlassian Jira, and many others.

I believe Vertical SaaS is gonna be one of the largest and most exciting software categories over the next decade.

Why it’s a big opportunity?

First of all many more companies are now digital by default and have been already using some patchwork of disjoint solutions. Especially post-COVID, customers have a high bar for the digital capabilities of even the smallest businesses. Companies need digital products for every function to not only provide world-class customer experience but also automate the business and increase profit margins, and they're realizing that a suite is superior to a patchwork.

Vertical SaaS applications bundle many horizontal solutions typically in simplified manner: ERP + CRM + contracts/invoices + some sort of email marketing + forms, etc.

This may just seem like a bundle of commodity products. Indeed, there often are point solutions that are better in absolute terms because they have more rich functionality since they do one thing very well. However, a typical business needs many such horizontal apps which will also go to cost. When you start stitching these tools together you start wondering where’s the source of truth for the list of active customers, their lifetime value, marketing data, active contracts, products in stock, etc. Yes, you can use Zapier but you will never have a seamless experience and a single source of truth for your business.

On the other hand, vertical SaaS apps provide a system of record for the business, are purposefully built for specific use cases and support best practices, and tailor UX to better serve the vertical.

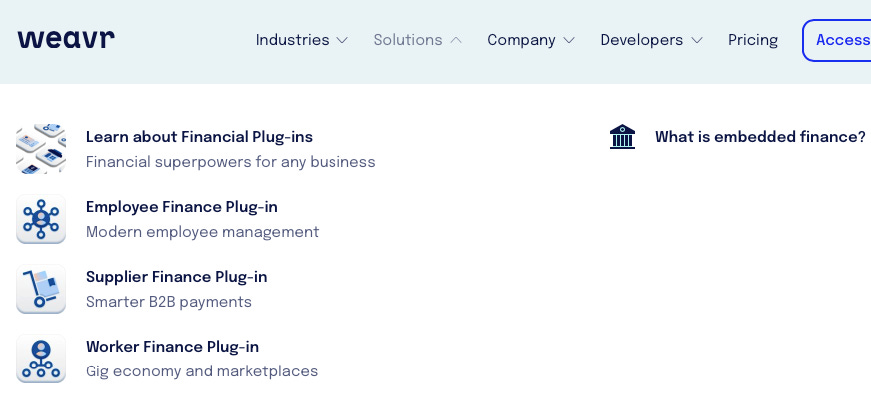

But most importantly there’s a new Embedded Fintech market emerging (market projected to reach $7 trillion) which enables any business to integrate financial services to create new customer experiences. This in return allows SaaS to monetize not only via subscription but also via embedded fintech products — such as transaction processing, loans, insurance, and others — such businesses are in the position to offer the right service at the right time because they understand the context, they understand the customer. This way SaaS solutions can create and capture more value for their customers and it’s also very attractive for the company as well because this is a very high-margin business.

A great example of the company benefiting from the SaaS + Fintech product (lending) model is Lendis: these guys lend office equipment (laptops, furniture) to their customers and offer SaaS to manage all of that equipment.

Embedding fintech improves retention by making the product stickier and also adds additional revenue streams. With an embedded service, the SaaS provider can draw on a proprietary set of data – ex for a lending product for a specific niche – to underwrite risk, factoring in things like a specific business model to better tailor the financial product to the customer’s needs. A good example is Nathan Latka’s Founderpath which has recently raised $145m on its balance sheet to offer revenue-based loans to SaaS businesses. You connect your Stripe and other SaaS tools and Founderpath estimates how much your business is worth and turns your monthly subscriptions into an upfront loan with a click of a button.

Embedded Fintech improves not only LTV but also CAC

There are several ways how embedded fintech can impact your go-to-market efficiency:

by increasing LTV you can utilize previously untapped marketing channels (ex. hire outbound inside sales team for SMB SaaS product) that were not ROI positive before;

you can offer SaaS products for less or even for free to wedge into a customer base that was either reluctant to digitize or was not ready to pay SaaS fees.

even at the same price, you’re offering more value (SaaS + Fintech) to your customer base which will increase your opportunities won close rates.

In 5-10 years, this playbook will be well known and the space more competitive or even commoditized, as SaaS has become over the last 10+ years. But right now there are significant opportunities for entrepreneurs to launch fascinating end-to-end Vertical SaaS products with embedded Fintech.

I wonder though what would be the next decade's opportunity?