You've Reached Product-Market Fit, Now What?

It’s been few years as you’ve reached product-market fit (PMF). Your company is scaling fast, ARR is growing 40-50% YoY, you're onboarding new employees every week. You’re hiring sales reps to support the demand marketing team has generated. New competition pops up and you’re on the verge of deciding on the next steps of your winning strategy.

One of the most common frameworks being studied in business schools is Michael Porter’s approach to do structural analysis of industries and companies in the industry. The framework is outlined in the book “Competitive Strategy: Techniques for Analyzing Industries and Competitors“. A very quick summary of the book could look like this.

The worst industry is the one that has all/most of these:

all of the players in the market are the same and their products don’t have unique differentiation (i.e. commodity products);

switching costs are close to 0 - customers can easily compare offers from different vendors and move from one vendor to another without a hurdle;

every player on the market has the same tech and the production costs are the same across all vendors;

To continue the growth you will make decisions to (1) differentiate your offering to better serve your target audience, (2) increase your business defensibility so that your competition can’t outpace and outgrow you and (3) timely reacting to market dynamics changes.

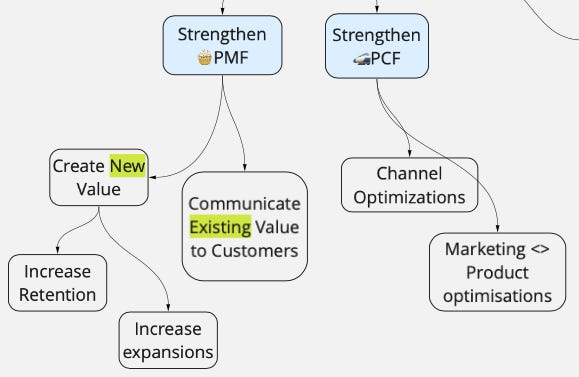

Business growth is a function of product-market fit (PMF) strength, product-channel fit strength and market dynamics.

These are the typical areas where your growth can be hindered. It’s also paramount to think ahead of time of what your strategy to win the market is even before you hit the ceiling of growth.

Let’s explore ways to defy the odds and continue your path to becoming a unicorn 🦄 and beyond.

Continue Growing Within Existing PMF

First things first, let’s start from the most obvious one. Your TAM is big, your marketing team can still generate demand and high quality leads through a combination of content marketing, SEO and performance marketing. You probably use affiliate marketing and channel sales through partnerships as well and can continue steady growth.

In this case you should allocate majority of your resources and capital into 2 categories:

Improving your PMF (product-market fit)

invest into onboarding and activation of new prospects;

invest into engagement of your customer base in the first 30-60 days (drive early retention);

build additional features to better solve the core problem of your existing target audience;

improve the product across pricing plans to drive upgrade motion and increase your Net Revenue Retention (one of the most important metrics in SaaS)

Improving your PCF (product-channel fit)

improve CAC of the existing channels;

experiment to find new channels;

improve the handoff of leads from the marketing website to the signup funnel of the product (personalisation, tailored onboarding, etc)

(I know it sounds easy when in reality it’s hard but we’re not trying to dig deep into each approach today as every one of them requires an essay on its own 😄)

Expanding the PMF

Your demand generation team is struggling to drive more traffic (you’ve reached ceiling in growing organic traffic and/or paid channels don’t work anymore), you’re observing the competition closing the gaps in their products and the value add of your offering isn’t compelling enough to switch customers.

Let’s see what are the common ways to continue the growth.

Horizontal Expansion

Your company has achieved PMF for specific customers’ Job to be Done (JTBD) and you start adding additional solutions to solve adjacent Jobs to be Done.

Reforge.com started from niche courses teaching PMs everything about growth but then expanded to other course topics (not they have more than 10 courses for pms, marketers and even engineers);

Amazon started from selling books but after 4 years rapidly added more categories like toys, DVDs and etc;

PandaDoc started in e-signature and proposal management software categories but then added CPQ and contract management use cases.

Vertical Expansion

Moving up or down the value chain to extend your market size. You decided to beat the competition by providing an end-to-end solution for your customers and add additional products or services within the same JTBD.

when Toast started, it was yet another point of sale system in a red ocean of competitors. Toast laser focus on restaurants and used POS as control point and layer on additional downstream products and business lines;

Amazon created their own logistical centres to replace the need to hire 3PL providers;

Docusign has been offering e-signature services for a long time but in 2018 acquired SpringCM to move beyond its bread and butter niche to expand vertically into contract management and build what it calls the System of Agreement.

(You can read my thoughts on the reasons for Vertical SaaS being one of the most lucrative business ideas in the next decade here).

GEO Expansion

Uber and Airbnb expanding beyond New York throughout the entire US and then abroad. Netflix launched in US, shortly after expanded to Canada and then to Europe, so you got it.

Entirely New Product Using Existing Assets

More generalised approach that somewhat includes all of the options above is leveraging existing assets (customers, data, technology, partnerships, etc) to build a new business line. You typically build a completely new product unrelated to the core business line.

Uber had created a distribution channel (Uber app and it’s audience) and launched Uber Eats leveraging their existing customers and also the technology;

Uplead (email finder solution) has leveraged existing sales audience and launched e-signature product (could be also attributed to vertical expansion);

Yandex has been enjoying maps product for a long time and then they’ve launched Yandex Taxi product using existing maps infrastructure.

Double-Down on Defensibility

Competitive advantages like speed, unique team, differentiated product, capital, content and others help your company become successful. Defensibility helps you stay there. If you’re able to move past competitive advantages to true defensibility — to really being able to protect your business from competition — your value grows exponentially.

Hamilton Helmer in his must-read strategy book 7 Powers: The Foundations of Business Strategy defines 7 defensibility strategies.

Network Effects (examples: LinkedIn, Facebook, TikTok, Salesforce). A business where the value realized by a customer increases as the userbase increases, i.e. when another user makes the service more valuable for every other user. Once your company gets ahead, users won’t find as much value in your competitors’ smaller networks. You would think that Network Effects can be only achieved for consumer products, but that’ not entirely true. It can be also applicable to B2B as well - Salesforce extended their APIs and allowed ISVs to build 3rd party solutions and market them on AppExchange. Then Salesforce launched their Trailhead product (free courses to learn how to build, launch and administer apps and Salesforce overall) which has further driven the flywheel effect: more developers build niche extensions, more customers, more ISVs and independent developers are interested in learning and making money on Salesforce ecosystem.

Scale Economies (example: Amazon, Walmart, Netflix). Per unit costs decline as volume increases. This means higher gross margin, means you can invest more into product/marketing or sales, more users means more volume, means you can get cheaper prices from suppliers (if any), means lower prices for customers, means higher conversion rates, makes your advertising more effective than your competition. The flywheel goes on.

Brand (examples: Tiffany, Booking.com, Google). A business that enjoys a higher perceived value to an objectively identical offering due to historical information about them. With brand, a certain company can stand top of mind when we think of something we need, Tiffany can charge high prices for actually not-so-high-quality diamonds and jewellery because of their more than 180y heritage and brand promise. Further, people come to identify themselves with brands. People who want to associate with Apple products will not comparison shop. Those psychological barriers make it very hard for competitors to break in.

Switching Costs (examples: Workday, Oracle, SAP, Salesforce, many other Enterprise software). A business where customers expect a greater loss than the value they gain from switching to an alternate. This works when you integrate your software into a customer’s operations so the customer can’t easily rip you out and replace you with a competitor. The more business critical your software is and the more integrations with other customer systems you’ve deployed, the more gross and net retention you can enjoy.

The four defensibility strategies are the most common ones and scale with you as the company grows. As you’ve imagined based on the book name, there’re 3 more:

Counter Positioning (examples: Netflix, Walmart) typically happen during the early stages of company’s life and means that business adopts a new, superior business model that incumbents cannot or unwilling to copy due to the anticipated cannibalization of their existing business or other reasons. One of the reasons Netflix successfully won over Blockbuster was the fact that Netflix didn’t take any fees for late return. This (among other reasons) allowed them to rapidly take over market share from Blockbuster that wouldn’t want to adopt the same approach given late fees accounted for more than 15% of the revenues.

The other 2 defensibility strategies are ‘Cornered Resources’ (A business that has preferential access to a coveted resource that independently enhances value. Example: Pixar) and ‘Process Power’ (A business which organization and activity set enables lower costs and/or superior products that can only be matched by an extended commitment. Example: Toyota Production System) are in my humble opinion arbitrary and are extremely rare to find on the market.

(social preview image credit goes to Design Manila Studio)